Offshore Trust Setup Fees and What You Should Plan For

Wiki Article

Explore the Services Provided by Offshore Trusts and Their Influence On Asset Monitoring

When you take into consideration possession administration, overseas counts on could not be the very first point that comes to mind, but their prospective can not be ignored. What's more, the best overseas count on framework can hold the secret to safeguarding your financial future.

Understanding Offshore Trusts: A Short Overview

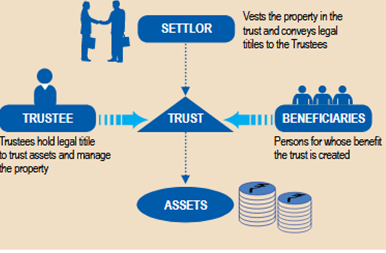

When you take into consideration protecting your properties and preparing for the future, recognizing offshore depends on can be essential. An offshore trust fund is a legal plan where you position your assets under the control of a trustee in an international territory. This setup enables you to handle your wide range while delighting in possible benefits like decreased tax obligations and lawful defenses.Establishing an offshore depend on often involves choosing a reputable trustee and identifying the depend on's framework-- whether it's optional or dealt with. You'll require to decide what possessions to include, such as property, financial investments, or cash money.

The key objective of an offshore trust is to secure your possessions from financial institutions, claims, or various other monetary hazards. Furthermore, it can give adaptability in just how and when your recipients obtain their inheritance. By realizing these principles, you're much better equipped to make enlightened choices regarding your monetary future.

Personal Privacy Benefits of Offshore Trusts

How can offshore trusts enhance your personal privacy? By developing an overseas depend on, you can successfully secure your possessions from public examination. The count on structure permits you to maintain ownership details personal, making sure that your personal information continues to be safeguarded. This privacy can discourage prospective suits and creditors, offering you satisfaction.Furthermore, several overseas jurisdictions have strict personal privacy laws that protect against unapproved access to depend on information. This suggests that also if someone tries to explore your monetary events, they'll deal with significant obstacles. You'll additionally take advantage of the discernment that includes collaborating with reputable overseas professionals who recognize the value of privacy in possession management.

In enhancement, overseas counts on can aid you maintain a low account, as they often run outside the territory of your home country. By leveraging these privacy advantages, you can secure your riches and protect your tradition for future generations.

Tax Obligation Advantages and Ramifications

When taking into consideration offshore depends on, you'll locate substantial tax obligation benefits that can enhance your monetary method. It's essential to stay notified concerning conformity and laws to stay clear of potential mistakes. Comprehending these aspects will certainly aid you make the most of your offshore asset administration.Offshore Tax Perks

Numerous people and businesses transform to overseas depends on for their tax advantages, looking for to optimize their financial techniques. By putting your properties in an overseas trust, you may benefit from lower tax obligation prices, possible exceptions, or delayed tax obligations, depending on the jurisdiction you pick. Furthermore, overseas depends on can create possibilities for estate preparation, ensuring your recipients obtain their inheritance with lessened tax implications.

Compliance and Laws

While offshore depends on offer notable tax obligation advantages, steering with the conformity and regulatory landscape is important to maximizing those benefits. You require to recognize that various jurisdictions have distinct policies pertaining to reporting and tax. Remaining certified with these laws not only protects your assets however likewise stops expensive fines.By remaining educated and compliant, you can fully leverage the tax obligation benefits of your offshore depend on while securing your financial future. Remember, the appropriate technique can make all the difference in effective property administration.

Estate Preparation and Riches Preservation

When it involves estate preparation and wealth conservation, offshore trusts supply substantial advantages that can safeguard your assets. By applying wise property security strategies, you can guard your wide range from prospective threats and ensure it benefits your beneficiaries. Understanding these devices can help you produce a solid prepare for your monetary future.Benefits of Offshore Depends On

Offshore trusts use significant advantages for estate planning and wealth conservation, especially for those seeking to protect their possessions from possible dangers. By positioning your assets in an overseas depend on, you can attain greater personal privacy, as these trust funds typically secure your estate from public scrutiny. They can likewise help minimize estate tax obligations, depending on the jurisdiction, permitting even more of your wealth to be passed on to your recipients. Additionally, overseas why not try this out trusts offer versatility in property management, enabling you to dictate exactly how and when possessions are distributed. This control can be necessary for ensuring your beneficiaries manage their inheritance wisely. Ultimately, utilizing an overseas check my site count on can improve your economic protection and legacy, making it an important tool for efficient estate preparation.Possession Security Techniques

Effective property protection methods are essential for securing your wide range and guaranteeing it endures for future generations. By using overseas trusts, you can develop a durable framework that guards your properties from financial institutions, lawsuits, and prospective financial threats. Developing a trust in a jurisdiction with solid privacy legislations includes an extra layer of security.Possession Protection From Creditors and Legal Claims

While several individuals seek to grow their wealth, safeguarding those possessions from financial institutions and lawful cases is just as important. Offshore depends on supply an effective remedy for guarding your properties. By positioning your wide range in an overseas count on, you produce a legal barrier that can help shield your assets from potential lawsuits, creditors, and other claims.These trusts frequently operate under favorable laws that can make it hard for financial institutions to access your possessions. When you establish an offshore trust, you're not just shielding your wide range; you're likewise getting peace of mind knowing your properties are safe.

In addition, the privacy given by lots of offshore territories can prevent prospective claims, as they might not even know where your assets are held. By proactively making use of an offshore trust, you can assure your riches remains undamaged, enabling you to concentrate on development and future chances without the constant concern of financial hazards.

Investment Flexibility and Diversity

When you invest with an offshore trust fund, you get significant adaptability and opportunities for diversity (offshore trust). Offshore counts on permit you to access a larger variety of financial investment choices, consisting of global markets and different assets that may be restricted or less obtainable domestically. This expanded reach enables you to tailor your profile according to your risk resistance and economic goalsAdditionally, you can easily adjust your financial investment strategies in action to market problems or personal situations. The capacity to allocate funds across different asset classes-- like property, supplies, and bonds-- further improves your possibility for development while managing danger.

With reduced regulatory restrictions and a lot more desirable tax obligation therapy in lots of overseas territories, you're encouraged to maximize your investments. This versatility not only aids in taking full advantage of returns however additionally guards your assets from volatility, making certain an extra stable monetary future.

Picking the Right Offshore Trust Fund Framework

Different types of frameworks, such as optional counts on or taken care of counts on, provide unique benefits. Discretionary trusts give versatility in distributing properties, while dealt with trust funds ensure beneficiaries obtain established shares.

Often Asked Inquiries

How Do I Select a Trustee for My Offshore Depend On?

To pick a trustee for your offshore count on, examine their track record, experience, and experience. Make certain they understand your goals and communicate efficiently. Dependability and dependability are crucial for taking care discover here of and shielding your properties properly.Can Offshore Trusts Be Made Use Of for Philanthropic Purposes?

Yes, you can make use of overseas trust funds for philanthropic objectives. They enable you to support causes while taking advantage of tax benefits and property defense, guaranteeing your humanitarian goals align with your financial strategies properly.What Are the Prices Connected With Establishing an Offshore Count On?

Establishing an offshore trust fund includes different costs, consisting of lawful fees, administrative costs, and potential tax obligations. You'll want to spending plan for these costs to ensure your trust is correctly established and maintained in time.

Exactly how Do I Transfer Assets Into an Offshore Trust?

To move possessions into an offshore trust, you'll require to collect the necessary documents, finish the count on arrangement, and officially transfer possession of the assets, making certain compliance with pertinent regulations and policies throughout the process.What Takes place if I Return to My Home Country?

If you return to your home nation, your overseas depend on might deal with different tax obligation implications. You'll require to consult with legal and tax obligation experts to recognize the prospective effects on your possessions and trust framework.Conclusion

To sum up, overseas trusts provide you a powerful way to improve your property monitoring strategy. Choosing the best offshore depend on framework enables you to take complete benefit of these advantages, guaranteeing your financial legacy remains flourishing and intact.By placing your assets in an offshore trust, you might benefit from reduced tax obligation prices, possible exceptions, or postponed tax obligation responsibilities, depending on the territory you select. By putting your possessions in an offshore count on, you can accomplish higher privacy, as these counts on typically protect your estate from public scrutiny. Additionally, overseas trust funds give versatility in possession management, enabling you to determine just how and when possessions are distributed. Different kinds of frameworks, such as discretionary trusts or dealt with trust funds, use distinct advantages. Optional depends on offer flexibility in dispersing possessions, while repaired trusts assure beneficiaries receive established shares.

Report this wiki page